In order to have full access of this Article, please email us on thedocumentco@hotmail.co.uk

Introduction:

Taiwan globally for IT competitiveness, by tradition, has been an open economy with sound economic policies and export-oriented strategies. Beginning from Export Processing Zones to a shift to Science Parks, Taiwan has firmly established its local industries and broadened its technological base. Taiwan’s GDP has been one of the highest in the world, and with electronic products constituting a large part of its export portfolio, the country is renowned for adding sizeably to the global trade in electronics. Chew, et al. (2007) identify through their work that an astounding 55,054% of Taiwan’s export portfolio was contributed toward the world share of electronic goods. Further, though the Taiwanese exports are concentrated toward the China, Hong Kong and USA markets, there is a strong reason to believe that Taiwan is in no way dependent upon these economies for its sustenance. This is substantiated by the fact that foreign direct investment and foreign reserves have had a minimal role to play in its growth, and most of it has been supported by national savings and internal funding.

The importance of Porter’s Diamond Model in analyzing competitiveness:

Michael Porter put forward his Diamond Model to explain the competitiveness of nations in the midst of global competition. Porter, through his model, identifies factors that lead to some countries being more successful in particular industries compared to others. He elaborates on four major underlying attributes that determine this competitive advantage. These are factor conditions, demand conditions, related and support industries, and company strategy, rivalry and structure. In addition to these factors, he mentions government policies and chance that facilitate this process, but these additional factors do not contribute to long lasting competitive advantage. At the very heart of the Diamond Model lies the notion that these above mentioned factors are created, not inherited. This means that an economy can, over time, develop and polish these attributes to gain competitive advantage.

Also, Porter introduced the concept of clusters, a set of interconnected firms, related industries and suppliers that spring up in certain locations and then realize mutually beneficial gains.

This concept of clusters, as shown by the work of Basu (n.d.), is important in our analysis because it suggests how government policies can influence macroeconomic factors such as taxes to stimulate demand, how investment in education produces a skilled workforce that automatically result in greater advancement in industries, how supporting and related industries help in reduction of input costs and assist economies of scale, and how the existence of competition urges companies operating within an industry to keep innovating and cutting costs to capture as much of the market share as they can.

Applying Porter’s Diamond Model to the Taiwanese electronics cluster will help us understand how this industry has managed to develop into one of the finest industries globally.

Factor Conditions:

The Diamond Model suggests that there are basic and advanced factors that form the subdivisions of factor conditions. Basic conditions such as geographical area, climate, and raw materials, unskilled labour and natural endowments such as water resources are inherited and investment into these is less significant when using them in the production process. Whereas, advanced factors such as skilled labour, capital and infrastructure are the resultants of reinvestment and innovation that in turn form the basis of competitive advantage as Smit (n.d.) describes.

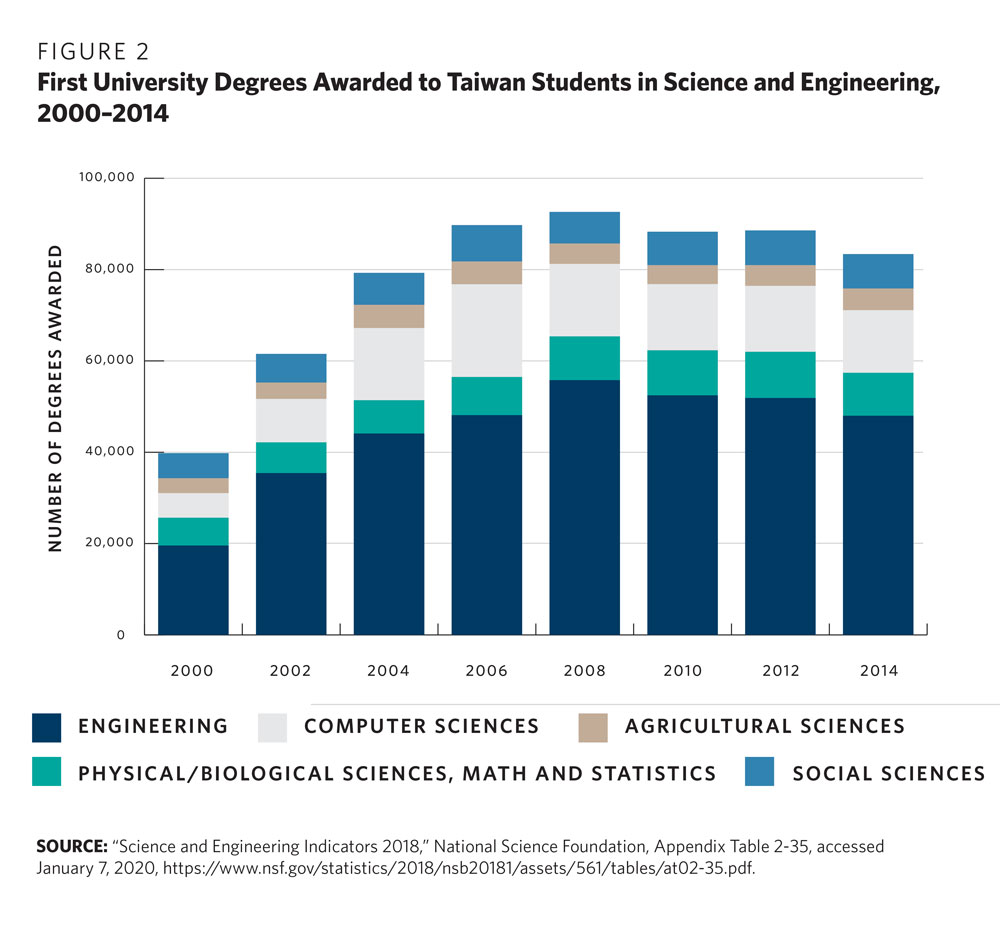

Kuo (1995) identifies that the reason for rapid growth of the electronics industry in Taiwan in mid 1960s was the inflow of foreign direct investment. Foreign ventures arrived in Taiwan to take advantage of its cheap labour. However, a decade later, local entrepreneurs and small and medium sized local companies took over this monopoly of foreign investors and the ownership of the industry changed. Further, as reported in Diane Publishing (n.d.), Taiwan has the best trained corps of engineers and scientists in the far-east outside of Japan indicating a healthy supply of skilled labour. The excellent public sector education in Taiwan leads to a turnout of one million graduates every year among which the ratio of high skilled professionals is very high (Chew, et al., 2007).

The Taiwanese government has also been pushing for knowledge intensive industries rather than labour intensive industries. The Electronics Research and Service Organization (ERSO) and its parent Industry Technology Research Institute (ITRI) are 40% publicly funded and have incorporated computerized industry control systems (Diane Publishing, 1995). This is a very important indication of the how the Taiwanese government has facilitated factor conditions in the electronics cluster to match up to global competitors namely China and South Korea. These two research facilities have improved the quality control procedures in the industry.

Also, as mentioned before, and reinforced by Ranis (2002), Taiwan’s open economy is an added benefit. Most importantly, the advanced factor of a developed infrastructure is vital if competitiveness is to be realized. In the case of Taiwan, its strategic location and its infrastructure reduce its transportation cost to its trade partners and neighbours Japan, South Korea and China (Lall, 1998).

Demand Conditions:

An economy gains competitive advantage globally when its local demand is anticipatory of foreign demand. It is when local demand becomes sophisticated that local firms start predicting what the foreign market would look like. They incorporate low input cost to their cost structure while at the same time maintaining high quality and using innovative strategies to match up to local demand. Taiwan’s high GDP per capita (Chew et al, 2007) is indicative of a generally high-income consumer base.

The protectionist policies and financial interventions of the Taiwanese government during the developmental stages of the economy in the 1960s greatly contributed to stimulating local demand that finally became indicative of foreign demand. As further explained by Ranis (2002), it was not long before these policies aided the entry of local entrepreneurs into international markets.

The Taiwanese government has, in addition, been phenomenal is helping firms gain market exposure through the procurement of advanced technology products (Porter, 1998). The flexible tax system is also used to advance…

Recent Comments