This article consists of 9 pages and 1472 words. In order to have full access to this article, email us at thedocumentco@hotmail.co.uk

Ref No: 1405

The module is based on statistical analysis to analyse the impact of sales and ROE on the salaries of CEOs. The data was collected for 100 companies randomly where annual salary and sales for year 2000 are taken into account and the ROE has been calculation as average return on equity for the three year period from 1998 till 2000.

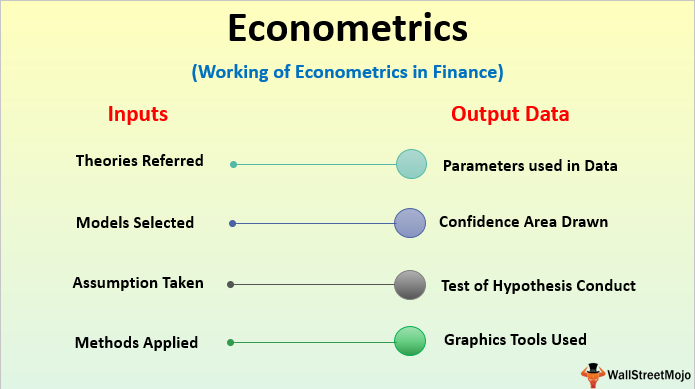

The analysis is mainly based on regression analysis, Jarque-Bera test and Ramsey’s RESET. Econometrics the analysis has been performed by using a statistical software namely Gretl.

Interpretation of Coefficient of Sales in the 2nd Regression Model

The second regression model analysis whether there is a statistically significant impact of Sales and ROE on the salaries of CEOs. The results of the second regression model are shown in the figure below:

Figure 1 – Second Regression Model

The figure above shows that the coefficient of sales in the second regression is 0.0215 which means that with every $1000 increase in sales, the salary of the CEO increases by $21.5. It can also be interpreted that there is a positive relationship between the sales generation of the company and the salary of the CEO.

Analysis of Signs of Coefficients of Sales and ROE

Econometrics In the view of Stanwick and Stanwick (2001), there is a direct relationship between the salary of CEO and sales and ROE of the firm. It is further stated that as the sales and ROE of the company gets higher, the CEO’s salary is also higher in such cases.

As analysed from the regression results in figure 1, the coefficients for sales and ROE are 0.0215 and 14.8608 respectively. The coefficient shows that there is a positive relationship between the Sales, ROE and the salary of CEO. Tosi, Werner, Katz and Gomez-Mejia (2000) also support the findings as they found that the salaries of CEOs are higher if the revenue generation of company is higher and it is also able to make higher ROE.

It is further stated that higher sales generation is the reason behind higher salary of the CEOs of multinational and big companies.

This analysis illustrates that the signs of coefficients of sales and ROE calculated for this analysis are aligned with the findings of past researchers analysed in this section.

Statistical Significance of Second Regression Model

In accordance with Kutner, Nachtsheim and Neter (2004), the significance of the regression model is analysed by the p-values or F value obtained in the regression model.

The regression model is said to be significant at 5% significance level when the p-value or F value is lower than 0.05; this means that the null hypothesis is rejected at 5% significance level and there is a significant impact of independent variables on the dependent variable.

Null Hypothesis: There is no significant impact of sales and ROE of a company on the salary of the CEO.

Alternate Hypothesis: There is a significant impact of sales and ROE of a company on the salary of the CEO.

As shown in the 2nd regression model in figure 1, the p-value (F) for the regression model is 0.0133 which is lower than the critical value of 0.05 and leads to rejection of the null hypothesis. Therefore, it can be stated that there is a significant impact of sales and ROE of a company on the salary of the CEO.

As analysed earlier, it can be stated that there is a positive and statistically significant relationship between the dependent and independent variables.

Test for Normality of Residuals from First Regression Model

Econometrics. The first regression model analyses whether there is a significant impact of sales on the salaries of CEOs. The test for normality of residuals for the 1st regression model is carried out by a histogram and Jarque-Bera test. The null hypothesis and alternate hypothesis for Jarque-Bera test is as follows:…

Recent Comments